Gap Insurance vs. Loan/Lease Payoff

If you’ve recently purchased a car using financing, you’re probably looking at these types of insurance. In fact, if you bought your car from a dealer, there’s a good chance they talked to you about or sold you some GAP insurance to go along with your car. That’s because if you took out a loan or financing to buy your car, this type of insurance will cover you in the event of your car being totaled.

If you’ve recently purchased a car using financing, you’re probably looking at these types of insurance. In fact, if you bought your car from a dealer, there’s a good chance they talked to you about or sold you some GAP insurance to go along with your car. That’s because if you took out a loan or financing to buy your car, this type of insurance will cover you in the event of your car being totaled.

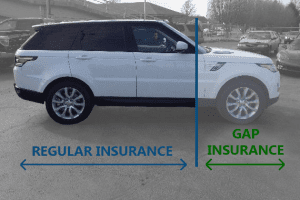

GAP Insurance and Loan/Lease Payoff both work on the same principle. Cars depreciate in value fast, just driving a car off the lot takes its value down a significant margin. Any loan payments you have to make on that car, however, do not depreciate. This means that when you total your car and your insurance company pays you the value of your car, it’s going to be less than the financing you took out to get the car, leaving you with no car and financing bills to pay off. GAP Insurance and Loan/Lease Payoff do exactly what they sound like in that situation, they cover the gap and pay off your loan.

As an example, say you really want that new BMW with the $25,000 price sticker and you decide to buy it. In order to ease the down payment you decide to take out a large loan of $20,000 and purchase the car. You now have a $25,000 car with $20,000 in financing to pay off. You drive off the lot and get back to your house when disaster strikes! Strong winds caused a tree to fall on your car and total it. Your insurance company decides that your car was worth $16,000 once you took it off the lot, so they cover that much towards a new car. But you still have $20,000 in financing to pay off, what do you do?

If you have GAP Insurance of Loan/Lease Payoff, you let them know what happened and they cover the other $4,000. GAP Insurance has the added benefit of often times paying for your insurance deductible as well, so there is no out of pocket cost for you to replace your car.

Both of these types of insurance are fairly cheap and widely available. If you ask for GAP Insurance while purchasing a lease, it can be included in the agreement. Often times it’s better to get outside insurance, but this isn’t a bad option. Considering how common low or no down payment vehicle options are becoming, it’s even more important that GAP Insurance is purchased and used.

Now that you know the idea behind these two types of insurance, let’s talk about what differences they have.

GAP Insurance:

- will cover any difference between the value of your car and your financing

- will most likely cover your deductible

- can only be bought soon after purchasing a new car (often there is a 30 day window)

Loan/Lease Payoff

- will cover up to 25% of the value of your car

- will not cover your deductible

- can be bought any time after purchasing your car

- cannot be applied to a loan from an individual

- Buying Salvage Cars: What to Expect on Auction Day - May 22, 2025

- Is Buying a Hail Damage Car Worth It? A Detailed Guide - December 2, 2024

- Affordable Luxury: The Best Budget Luxury Cars for Families in 2024 - November 21, 2024