Car Loans with AutoBidMaster

Exciting news, everybody. The final price of the car you’re dreaming about doesn’t have to stop you from bidding on it anymore. Car loans with AutoBidMaster are here. Don’t let final prices be the final say when it comes to missing an auction. With APR as low as 4.99%, you now have the option to make low monthly payments on vehicles that you’ve won at auction. Get approved, fast and easy – our partners accept applications for a wide range of income and credit scores. We’ll help you find car loans that are right for you.

What Is Car Financing?

If you are planning to try AutoBidMaster financing, you should definitely learn more about financing in general and familiarize yourself with this method of buying. So, what is financing?

Well, financing is a word that covers various financial methods that help individuals and businesses purchase cars without paying the full price upfront.

Car financing can come in various forms. What is worth noting is that each of these types has its own set of terms and conditions. But overall, car financing helps customers who cannot afford to pay the full price of a vehicle.

How AutoBidMaster Financing Works

AutoBidMaster is an online auto auction platform that allows users to bid and win salvage title vehicles. And in order to help its customers purchase their dream car, we offer AutoBidMaster financing.

AutoBidMaster cooperates with many financial institutions across the country and is able to deliver many financing options for its loyal customers. Here is a detailed look at how the whole financing process works:

Eligibility and Application Process

- Membership Requirement

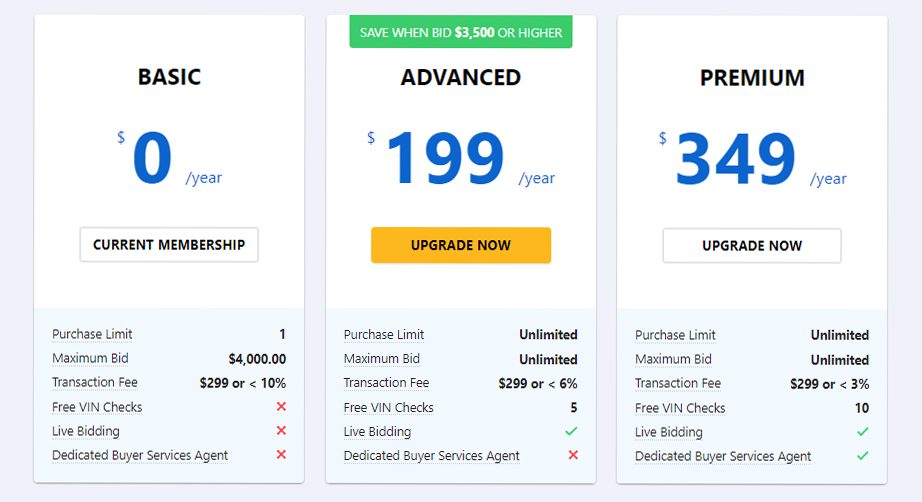

- Sign-Up: In order for you to be able to access the financing options, you have to be a member of AutoBidMaster. There are three levels of membership. Basic, Advanced, and Premium. Only Advanced and Premium members are eligible for financing.

- Eligibility Criteria

- Credit Check: Besides the Advanced or Premium memberships on the platform, you also need to have a good credit score and a good financial history. Money lenders evaluate this data before you get approved.

- Documentation: In order to be eligible for car auction financing, you also need to have documentation. This includes proof of income and other financial documentation that you will be required to provide.

Financing Options and Terms

- Loan Amount

- Coverage: auto auction financing can cover the full or partial cost of the vehicle. This really depends on the assessment of your creditworthiness, as well as on the value of the vehicle.

- Interest Rates and Loan Terms

- Rates: The interest rates depend on many different factors. Such as the lender, your credit score, the loan amount, and the length of the loan. These rates can be variable or fixed.

- Terms: When applying for auto loans for auction cars, you need to be aware of the terms. These terms vary between 12 and 72 months. Shorter terms have higher monthly payments but lower interest rates. While longer terms have higher interest and smaller monthly payments.

The Financing Process

- Applying for Financing

- Select Vehicle: The whole process starts with finding the car you really need. Make sure that the vehicle meets your criteria.

- Submit Application: After you find a vehicle that suits your needs, you can apply for financing through the AutoBidMaster platform. This application will involve completing a form with your personal and financial information.

- Approval and Terms Agreement

- Loan Offer: If you are approved by the lender, you will get a loan offer with all of the terms clearly listed. These terms include the loan amount, interest rate, monthly payments, and other additional fees.

- Agreement: What you should do is not rush. Read the loan offer and make sure that you agree to the terms before you sign. The conditions in the document have to be followed accordingly and payments must be on schedule.

- Payment and Vehicle Purchase

- Payment to AutoBidMaster: When it comes to auto auction purchase loans, the financial institution will pay AutoBidMaster directly. Your only focus will be to pay the monthly payments.

- Auction Fees and Taxes: You need to have some extra money because you need to cover the auction fees, taxes, and other costs. These are not covered by the financial institution.

Post-Purchase Obligations

- Monthly Payments

- Repayment Schedule: Whenever you get some sort of financing, you are obliged to make payments according to the terms in the agreement. These payments include the principal and interest.

- Insurance

- Coverage Requirement: What lenders require is full coverage on financed vehicles to protect their investment. You will also need to provide proof of insurance if you want to get a loan from a financial institution.

- Vehicle Ownership

- Title and Registration: When it comes to the title, the name will be on the financial institution until you pay off the loan. Once the loan is paid, the title will be transferred to you.

Pros and Cons of Car Financing

Car financing is one of the most practical solutions to acquire a certain vehicle. But as with anything in life, there are advantages and disadvantages. So, you have to understand the pros and cons in order for you to make an informed decision. For this purpose, we decided to cover these pros and cons in detail.

Pros of Car Financing

1. Affordability: One of the main reasons why you should opt for financing is definitely affordability. Financing a car is not a financial shock for you like buying it straight away.

You can spread out the payments across a year or a few years depending on the type of loan. The more installments you have, the lower the monthly payment.

2. Access To Better Vehicles: One big pro of financing is definitely the type of vehicle that you can purchase.

For example, if you decide to buy the car straight away, you will not have enough money to buy yourself something really nice. You will need to make a compromise and buy a car that is not up to your liking.

With financing, you are able to get a top car for a low monthly payment. This is why if you have a dream car, we recommend going for the financing route in order to obtain it and enjoy it while you are still young.

3. Building Credit History: If you are successfully managing your loans and you make timely payments, it will result in a higher credit score.

So, if you want to finance another car down the line, you will be able to do so because banks will compete to work with you. Every bank wants to work with clients who make their payments on time.

4. Higher Flexibility: A car loan can be customized in terms of the length, interest rates, and down payments. This gives you the flexibility to plan what works in your financial situation.

5. Tax Benefits: If you plan to purchase this vehicle on behalf of a company, you can also enjoy some tax benefits. This will result in a lower overall cost for the car.

Cons of Car Financing

1. Interest Costs: One of the biggest downsides of financing is definitely the interest costs. The longer the loan the more interest you pay overall.

On top of that rates can change depending on market conditions. Rates can go up and this will definitely affect your monthly payments.

2. Debt Accumulation: Taking car loans will result in higher debt. This means that you will have a harder time to get another loan.

For some people, for example, people who lose their job all of a sudden, keeping up with payments can become a problem. And if you cannot pay your monthly payments, your debt will rise even more. Your car can get repossessed by the bank, etc

3. Depreciation: Cars tend to depreciate very quickly. So, it can happen over a year or two that you lose plenty of the value.

This will result in poor resale value. This is why you should be aware of this and calculate the potential losses in value over the length of the loan.

Which vehicles are eligible?

Both clean and salvage title vehicles are eligible, but please confirm with our Buyer Services team before placing a bid as there are certain title brands that are ineligible for financing. As of right now, members in Massachusetts and New York can only finance vehicles with a clean title. “Gray market,” fire damage, recycled, stripped, and former taxi or police vehicles are also ineligible for financing.

How do car loans work?

To get approved, you can apply to finance a vehicle that you have already won at auction that is marked as run and drive by the yard. Please note that that means the vehicle ran and drove under its own power when it arrived at the yard, and may no longer do so. We always recommend getting a VIN report and inspecting vehicles in person before placing a bid. Please note that if you win a vehicle at auction and are not approved for financing, terms and conditions still apply and you are required to complete the purchase or pay relist fees.

Financing is only available to Advanced and Premium members in the United States at this time – and Premium members are eligible for lower APR! To learn more about vehicle financing, get in touch with our Buyer Services team. If you’re ready to upgrade to an Advanced or Premium membership, take a look at the image below.

Not only do you get the option to finance vehicles through AutoBidMaster with an Advanced or Premium membership, but you also get awesome perks like:

– No bidding or buying limits

– Reduced transaction fees

– Free VIN checks

– Access to live auctions

– Recommended bids based on past auction data

– and for Premium members: shipping discounts and reduced APR!

For more info about financing a vehicle through a car loan with AutoBidMaster, you can contact us directly. Otherwise, hit the button below to register and upgrade your account and start bidding on your next car, truck, SUV, or motorcycle.

Frequently Asked Questions (FAQ)

Now let’s answer some frequently asked questions.

What are the AutoBidMaster payment options?

All expensive transfers are done via bank transfer. You can use your credit card to make deposits and pay for your membership but overall, all of the purchases are done with bank transfers.

What is worth noting is that AutoBidMaster gives you the ability to finance your car. AutoBidMaster works with many banks that are willing to give you a loan and help you get your dream car.

The thing that you have to do is have a good credit score and be able to pay the monthly payments on time over the agreed period.

Can you finance a auction car?

Yes, you can finance an auction car. AutoBidMaster gives you this chance to go the finance route. This is the case because AutoBidMaster works with many financial institutions that are able to give you a loan with a single click.

Your task is to join AutoBidMaster and set up an Advancer or Premium account. Then you should pick the car you want, supply the right documents, and have a good credit score. The higher the credit score, the easier it will be for you to get the loan you need. The rest will involve paying the monthly rates over the agreed period with the bank.

Can you get a loan for an auction car?

Yes, you can get a loan for an auction car. The way to do this is by creating a profile on AutoBidMaster.com. You will need an Advanced or Premium membership for this purpose.

The next step will involve picking a car that is right for your budget and applying for a loan. This depends on how high your credit score is. The higher the credit score, the more chances you have to get this loan.

Then, the documentation has to be completed and the bank will pay AutoBidMaster for the car. Your job is to pay the monthly payments regularly over the agreed time period.

Get accurate vehicle reports via Title Check California today.

- The Advantages of Salvage Car Parts - November 3, 2025

- Buying Salvage Cars: What to Expect on Auction Day - May 22, 2025

- Is Buying a Hail Damage Car Worth It? A Detailed Guide - December 2, 2024